Understanding and meeting title loan vehicle condition requirements is crucial for securing quick approval. Regular maintenance, including engine care, tire health, and safety features, enhances your car's value and eligibility. Keeping detailed service records demonstrates financial responsibility, potentially leading to better loan terms based on current equity.

Looking to secure a title loan but unsure about meeting the vehicle condition standards? This comprehensive guide is your roadmap to success. We’ll break down the critical aspects of understanding and fulfilling the title loan vehicle criteria, offering practical tips on preparing your car for approval. Discover effortless ways to navigate these requirements and gain access to the funds you need with peace of mind.

- Understanding Title Loan Vehicle Criteria

- Preparing Your Car for Loan Approval

- Tips to Meet Condition Standards Effortlessly

Understanding Title Loan Vehicle Criteria

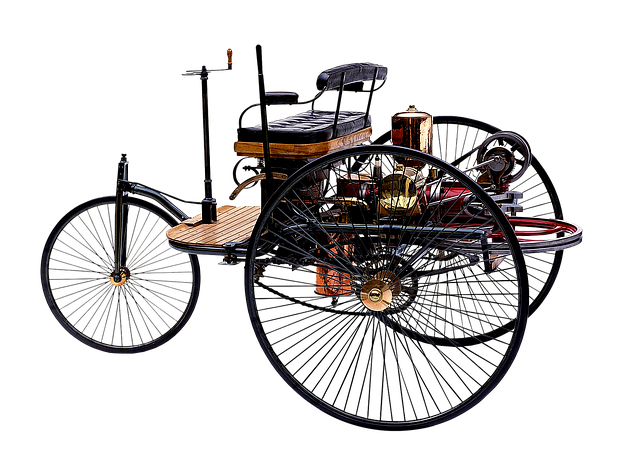

When considering a Title Loan, understanding the vehicle condition requirements is key to ensuring a smooth process and quick approval. Lenders have specific criteria for evaluating the state of your car or truck. These include factors like the overall condition of the vehicle’s structure, mechanical systems, tires, and any prior damage or accidents.

The primary focus is on the vehicle’s value and drivability. Even with some wear and tear, as long as your car meets basic safety standards and can be operated without major issues, it could still qualify for a loan. Lenders also consider loan eligibility based on your credit history and income, making it important to have accurate information ready when applying. This transparency streamlines the approval process, often leading to faster access to funds in comparison to traditional loan methods.

Preparing Your Car for Loan Approval

When applying for a title loan, ensuring your vehicle meets the condition requirements is step one to a smooth process and quick approval. Begin by conducting a thorough inspection of your car, checking for any outstanding repairs or maintenance tasks. A well-maintained vehicle not only improves its overall condition but also increases its value, which is crucial when determining your loan payoff amount.

Addressing any issues before applying can significantly enhance your chances of securing favorable terms. This process involves basic upkeep like ensuring the engine is in good working order, regular servicing, and keeping the exterior and interior clean and presentable. Additionally, checking the tire condition, brake functionality, and overall safety features are essential to demonstrate your vehicle’s reliability, thereby speeding up the loan approval process and potentially securing a higher cash advance based on its current equity.

Tips to Meet Condition Standards Effortlessly

Meeting Title Loan vehicle condition requirements doesn’t have to be a daunting task. Begin by keeping accurate and detailed records of your vehicle’s maintenance history. Regular servicing and timely repairs significantly enhance your loan eligibility. A well-maintained vehicle not only increases its value but also assures lenders of your financial responsibility.

During the vehicle inspection, ensure all essential components are in good working condition. This includes brakes, tires, lights, and fluids. Addressing these areas shows potential lenders that you’re committed to keeping your vehicle in top shape, a factor that can improve your loan eligibility and secure emergency funding when needed.

Meeting the strict Title loan vehicle condition requirements doesn’t have to be a daunting task. By understanding the criteria and preparing your car accordingly, you can increase your chances of approval and secure the funds you need quickly and effortlessly. With these simple tips, navigating the process becomes seamless, allowing you to focus on what truly matters – achieving financial stability with ease.