Understanding your vehicle's condition is crucial when applying for a title loan, as lenders assess factors like year, make, model, and overall wear to determine loan amounts. Maintaining your car's condition through regular cleaning, inspections, and routine maintenance can improve loan terms, rates, and save on interest fees by meeting the strict title loan vehicle condition requirements. This ensures a smoother same day funding process for borrowers and mitigates potential losses for lenders.

Looking to secure a title loan without extra fees? Understanding the vehicle condition requirements is key. This comprehensive guide delves into the essential aspects lenders consider during assessment, ensuring you maximize your loan potential. From mechanical soundness to aesthetic integrity, learn what’s involved in the process and how to maintain your vehicle’s value. By grasping these fundamentals, you can navigate title loan applications confidently, avoiding unnecessary charges and securing a favorable agreement.

- Understanding Title Loan Vehicle Condition Requirements

- What's Included in the Assessment Process?

- Avoiding Extra Fees: Tips for Maintaining Your Vehicle

Understanding Title Loan Vehicle Condition Requirements

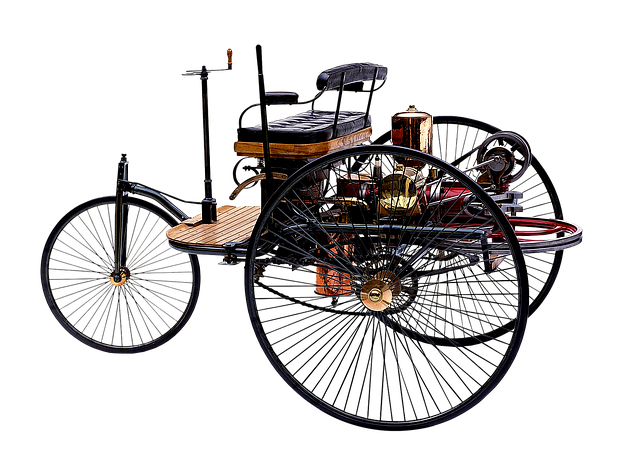

When considering a title loan, understanding the vehicle condition requirements is crucial to ensure a smooth title loan process. Lenders assess the value and condition of your vehicle to determine the loan amount they’re willing to offer. This evaluation is based on several factors, including the year, make, model, and overall condition of the car.

In most cases, lenders prefer vehicles that are in good working order with minimal damage or wear and tear. They look for signs of regular maintenance and proper care. While some lenders may accept older or high-mileage vehicles, they typically reserve these options for lower loan amounts. The vehicle collateral plays a significant role in securing the loan, so maintaining its condition can help you access better terms and rates, including potential savings on interest fees.

What's Included in the Assessment Process?

When evaluating a vehicle for a title loan, especially in the case of Dallas title loans or boat title loans, lenders consider several key factors to ensure the collateral’s value and condition. The assessment process involves an in-depth examination of various components to determine the overall state of repair and potential risks. This includes checking the vehicle’s history, mechanical functionality, cosmetic damage, and any recent repairs or modifications.

Lenders often require a comprehensive inspection report detailing the findings to make informed decisions about extending fast cash loans. This process is crucial in protecting both the lender and the borrower, ensuring that the collateral accurately represents its advertised condition. By assessing these factors, lenders can offer competitive rates and terms while minimizing potential losses, providing a fair and transparent experience for all parties involved.

Avoiding Extra Fees: Tips for Maintaining Your Vehicle

Maintaining your vehicle in excellent condition is not only beneficial for your safety and comfort but also plays a crucial role in avoiding extra fees when obtaining a title loan. Here are some tips to ensure your vehicle meets the strictest standards, keeping potential costs down. Regular cleaning and inspections can reveal issues early on, making it easier to address them promptly. This proactive approach can prevent more serious problems that might arise later, leading to costly repairs or even towing fees.

When it comes to the title loan process, lenders often assess the overall condition of your vehicle as part of their quick approval procedure. By keeping up with routine maintenance, such as fluid checks, tire pressure adjustments, and battery replacements, you demonstrate responsible ownership. These simple steps not only enhance your vehicle’s longevity but also contribute to a smoother same day funding experience during the title loan transaction.

When considering a title loan, understanding and adhering to vehicle condition requirements is key to avoiding extra fees. By familiarizing yourself with what’s included in the assessment process, you can proactively maintain your vehicle’s condition, ensuring a smooth borrowing experience. Remember, proper care not only saves you from unexpected charges but also extends the lifespan of your vehicle. In terms of title loan practices, prioritizing vehicle condition is a win-win for both borrowers and lenders.