When applying for a title loan, understanding the "title loan vehicle condition requirements" is key. Lenders assess factors like age, state, and damage to determine your car's value as collateral. Presenting a well-maintained (under 10 years old) vehicle with regular maintenance records typically meets these criteria, making it easier to access flexible payments for a smooth transfer process. To qualify, meticulously inspect your vehicle for damage or wear, address mechanical issues through basic maintenance and repairs, and provide accurate information including make, model, year, mileage, insurance, and registration during the application process.

“Looking to secure a title loan but unsure about your vehicle’s condition? This guide is tailored to help you navigate through the requirements without costly upgrades. We’ll explore the fundamental standards set for title loan vehicles, offering practical insights on assessing your car’s current state.

Furthermore, discover actionable tips to ensure you meet these criteria and increase your chances of obtaining the loan you need. Get ready to unlock access to quick funding while maintaining your vehicle’s integrity.”

- Understanding Title Loan Vehicle Condition Requirements

- Assessing Your Vehicle Without Upgrades

- Tips to Meet the Standards and Secure Your Loan

Understanding Title Loan Vehicle Condition Requirements

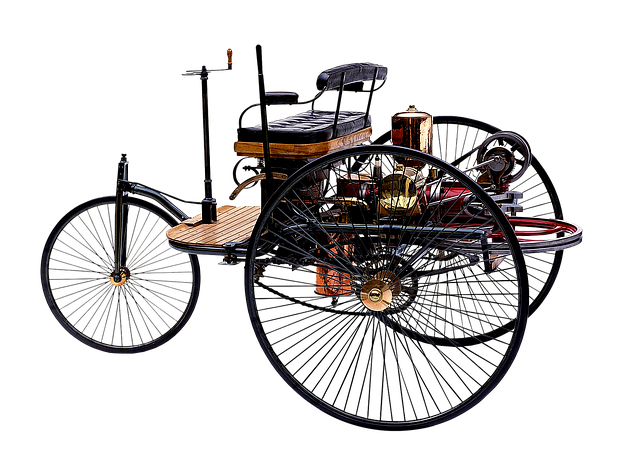

When considering a title loan, understanding the vehicle condition requirements is paramount. Lenders have specific criteria to assess the state of your car or truck to ensure it has enough value to secure the loan. This process involves examining the vehicle’s age, overall condition, and any existing damage or repairs. It’s about determining if the vehicle can serve as a viable collateral for the loan without significant upgrades.

Meeting these title loan vehicle condition requirements means presenting a well-maintained and reliable vehicle. Regular maintenance records can be beneficial during the evaluation process. Lenders often prefer vehicles that are within a certain age range, typically not more than 10 years old, to ensure optimal value. Flexible payment options are also part of the appeal, allowing borrowers to manage their loans comfortably while focusing on meeting the basic condition standards set by lenders for a smooth title transfer.

Assessing Your Vehicle Without Upgrades

When preparing your vehicle for a title loan, it’s crucial to understand the condition requirements without making any upgrades. This involves a meticulous assessment of your car’s current state. Start by examining its exterior and interior for any significant damage or wear and tear. Dents, scratches, cracked windows, or a worn-out interior can impact the overall value of your vehicle. Keep in mind that lenders typically look for a well-maintained and reliable asset as collateral for loans, so ensuring your car meets these basic standards is essential.

Consider the mechanical aspects as well. A thorough check-up with a trusted mechanic can reveal any underlying issues or repairs needed. Major problems like faulty brakes, a weak engine, or an outdated transmission system may hinder your loan application. However, minor maintenance tasks such as fresh oil changes, new filters, and basic repairs can significantly improve the condition score of your vehicle, making it more attractive to lenders. Remember, meeting these title loan vehicle condition requirements without upgrades is key to securing financial assistance, especially when facing urgent money needs with No Credit Check options available.

Tips to Meet the Standards and Secure Your Loan

Meeting Title loan vehicle condition requirements Without Upgrades can be a straightforward process if you’re prepared. Before applying, assess your vehicle’s overall condition. Major repairs or significant wear and tear might increase costs, so consider basic upkeep to ensure your car passes inspection smoothly. Regular cleaning, fixing minor damages like dents or scratches, and maintaining proper tire pressure are simple yet effective ways to boost your chances of loan approval.

During the application process, provide accurate information about your vehicle’s make, model, year, and mileage. This data will be cross-checked during the credit check stage. Ensure you have all necessary documents ready, including proof of insurance and registration. Additionally, arranging for a direct deposit as the funding method can expedite the loan approval process, making it easier to access your funds quickly without delays.

Securing a title loan can be a viable financial option, especially when understanding and adhering to the specific criteria for vehicle condition. By carefully assessing your car’s current state without requiring costly upgrades, you can confidently navigate the application process. These tips highlight practical strategies to meet the title loan vehicle condition requirements, ensuring a smooth borrowing experience. Remember, maintaining your vehicle according to these standards not only increases your chances of approval but also promotes financial stability.