Securing a title loan involves meeting strict vehicle condition requirements set by lenders. These include minimal damage, regular maintenance, valid registration, and favorable market value. Lenders in cities like Dallas conduct thorough inspections, considering accident history, liens, mileage, and maintenance records to assess the car's worth. Maintaining detailed repair and service records expedites the process and can secure better loan terms, ensuring a fair and safe borrowing experience.

Title loans, a quick source of funding secured by your vehicle, come with specific condition requirements. Understanding and adhering to these standards is crucial for a seamless lending process. This article breaks down the essential checks and evaluations needed to meet title loan vehicle condition requirements, offering practical insights on maintaining and documenting your vehicle’s condition. By following these guidelines, borrowers can ensure a smooth experience when pursuing a title loan.

- Understanding Title Loan Vehicle Condition Requirements

- Essential Checks and Evaluations for Title Loans

- Maintaining and Documenting Vehicle Condition for Title Loans

Understanding Title Loan Vehicle Condition Requirements

When applying for a title loan, understanding the vehicle condition requirements is crucial. Lenders assess the condition of your vehicle to determine its value and calculate how much financial assistance you can receive. In most cases, lenders look for vehicles with minimal damage, regular maintenance records, and a valid registration. This ensures that the asset being used as collateral is in good working order and can be easily sold if needed.

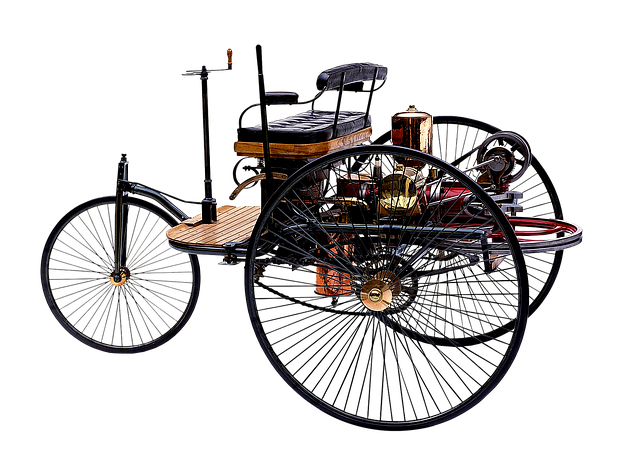

Title loan vehicle condition requirements go beyond just the physical state of your car. Lenders also consider factors such as the age of the vehicle, its overall market value, and the remaining balance on any existing loans or leases. For instance, while a well-maintained boat title loan might offer better terms through debt consolidation, the lender will assess the vessel’s condition to ensure it retains significant value. Meeting these conditions increases your chances of securing favorable rates and terms for your title loan.

Essential Checks and Evaluations for Title Loans

When considering a Car Title Loan, ensuring the vehicle’s condition is paramount. Lenders will perform essential checks and evaluations to determine the state of the collateral, which is critical for both parties. The process involves meticulous inspection of the vehicle’s history, including checking for any outstanding liens, accidents, or significant damage that could impact its resale value.

In addition to these fundamental assessments, lenders in cities like Dallas often assess the overall condition of the car, considering factors such as mileage, maintenance records, and mechanical soundness. This thorough evaluation is not just about meeting Title Loan vehicle condition requirements; it also ensures borrowers receive fair terms and conditions tailored to their collateral’s actual worth, facilitating a seamless and secure borrowing experience for obtaining emergency funds when needed.

Maintaining and Documenting Vehicle Condition for Title Loans

Maintaining a well-documented vehicle condition is paramount when considering a title loan. Lenders require detailed records of any repairs, maintenance, or modifications made to the vehicle as part of their evaluation process for loan approval. This ensures that the collateral they are lending against is in safe and reliable condition.

Regular upkeep and thorough documentation can make the title loan process smoother. Keeping up with routine servicing, such as oil changes, tire rotations, and brake inspections, not only extends the life of the vehicle but also demonstrates responsible ownership to potential lenders. During the title loan process, having comprehensive records readily available showcasing the vehicle’s condition can expedite approval and, in some cases, qualify you for a higher loan amount or more favorable loan extension terms.

When considering a title loan, understanding and adhering to the specific vehicle condition requirements is paramount. By performing essential checks, evaluations, and maintaining proper documentation, borrowers can ensure they meet these standards, facilitating a smoother lending process. This, in turn, allows for access to much-needed funds while safeguarding the lender’s interest in the value of the collateralized vehicle.